Reporting for Venture Capitalists

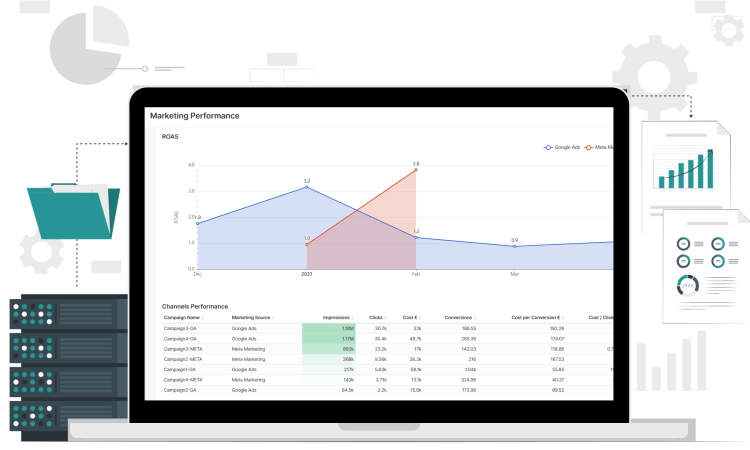

Venture capital firms and business angels benefit from standardized reporting on their portfolio companies, especially for investor data solutions.

Benchmarking

By utilizing centralized reporting systems, venture capital (VC) firms can effectively monitor the financial health of their portfolio companies. This proactive approach enables informed investment decisions and allows for prompt corrective action when necessary. Moreover, without standardized reporting, it would be much more challenging for VC firms to stay on top of their portfolio and ensure the success of their investments.

Investor Reporting

Investor reporting is also significantly enhanced through standardized reporting. VC funds are required to report the financial performance of their portfolio companies to their investors accurately and in a timely manner. Moreover, this level of transparency fosters trust between the fund and its investors.

Furthermore, Qmantic provides access to key performance indicators (KPIs) for independent investors, the transparency and accountability of VC firms are further enhanced. Consequently, investors can monitor the performance of their investments and make more informed decisions based on reliable data.

Service to Portfolio Companies

Despite their limited scope, these KPIs serve as a robust foundation for internal centralized reporting and controlling purposes. In the best-case scenario, they encompass business-model specific analysis, bolstering decision-making capabilities and propelling strategic growth.

Let's get started!

How do we start working together ?

Initial Call

Once you reach out to us, we schedule a call to understand your needs and unique requirements.

You get a proposal

Based on your input, we will send you a detailed proposal, including the pricing.

Implementation

You and your team will be able to test everything before you make a decision.