Running a Software as a Service (SaaS) business is like sailing through constantly changing seas. Subscription-based revenue, the lifeblood of SaaS companies, can be both a blessing and a curse when it comes to budgeting. To successfully navigate these turbulent waters, you need a solid understanding of the complexities involved in forecasting revenue. In this comprehensive guide on ‘SaaS Revenue Budgeting Tips,’ we will explore the intricacies of budgeting for a SaaS business, ensuring you’re well-equipped to chart a course for financial success.

The Dynamics of Subscription Revenue

At the heart of any SaaS business are recurring subscriptions. These steady inflows of revenue provide stability, but they come with unique challenges for budgeting. Unlike traditional businesses with one-time sales, SaaS companies must consider a myriad of factors when crafting revenue forecasts. Let’s dive deeper into these factors and understand how they impact your budget.

Upsells, Downsells, and Cross-Sells

In the world of SaaS, growth often means convincing existing customers to upgrade to higher-tier plans. These upsells, as well as the occasional downsell when customers scale back, directly influence your revenue. Additionally, cross-selling complementary products or features can boost your bottom line. To create an accurate budget, you must incorporate these elements into your forecasting model.

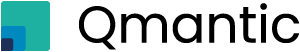

Churn Rates: The Budgeting Challenge 💰

Churn, the rate at which customers cancel their subscriptions, can be a significant obstacle to accurate budgeting. Your ERP system can provide you with the next renewal date of a subscription contract, but you must apply a reasonable churn rate to anticipate which customers won’t renew. Past churn rates serve as a valuable indicator, but if your customer base or their purchasing habits are changing significantly, consider modeling segments individually. This approach, such as distinguishing between Small and Medium-sized Businesses (SMBs) and Enterprises, helps you avoid unexpected revenue fluctuations due to shifts in your customer base.

Timing Is Everything

One common challenge faced by SaaS companies is the need to create a budget for the next year while the current year is still in progress. This means you often lack actual revenue figures for the last 2-3 months. To address this challenge, make your best possible estimates and revisit your budgeting logic in early January once you have the complete actuals from the previous year. Flexibility and adaptability are crucial when dealing with these timing issues.

The Power of Granularity: Why Daily Budgeting Matters

While your cost and revenue budgets are typically planned on a monthly basis, consider breaking down your billings budget into daily increments. Why daily?

Renewal Billings: Keeping a Close Eye

Planning daily helps ensure that you don’t miss any renewal opportunities. The subscription economy moves quickly, and even a day’s delay in renewing a contract can impact your revenue.

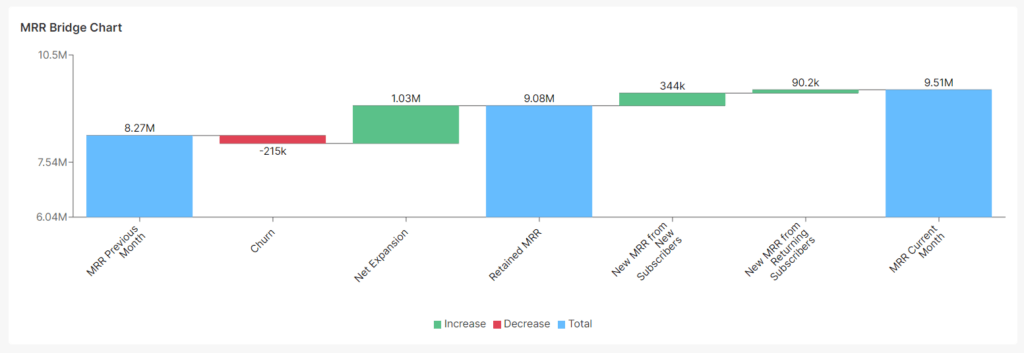

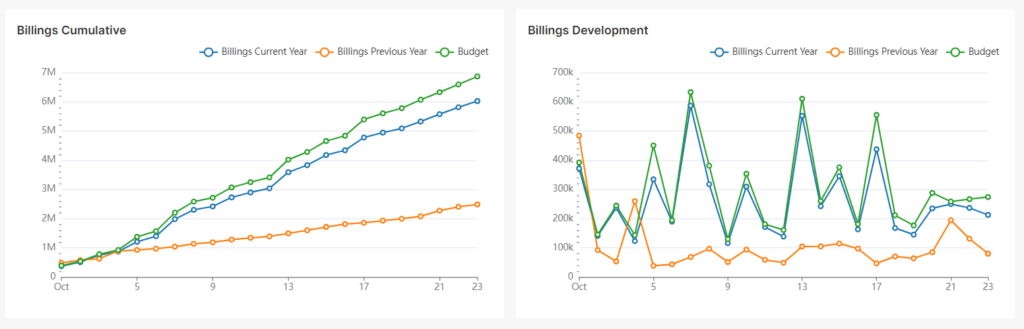

Real-Time Tracking for New Billings

Setting daily targets for new billings allows you to track your progress in real-time. With a month-to-date chart, you can see precisely where you stand and take corrective actions promptly. This level of granularity empowers you to adapt your strategy as needed to meet your monthly goals.

Accounting for Special Factors

Depending on the size and nature of your SaaS business, your budget should account for various factors that can influence revenue patterns.

Local Holidays

Local holidays can impact customer behavior. Understanding regional holidays and their potential effects on customer engagement and purchasing decisions can help you create more accurate forecasts.

Seasonal Trends

Product-based seasonality is a significant factor for some SaaS businesses. For instance, B2C sports and health subscription services often experience a surge in the first days of the new year as people make resolutions to improve their health. Recognizing and accounting for such patterns is essential for accurate budgeting.

Dimensions of Your Budget

A comprehensive budget should align with the dimensions of your reporting. Your “actual vs. budget” key performance indicators (KPIs) should be applicable to all slices and breakdowns of your business. Consider the following typical dimensions:

- Region/Country: Different regions may have distinct revenue trends and customer behaviors.

- Product: Your various products or service tiers may perform differently.

- Sales Team: Individual sales teams might have varying levels of success in driving revenue.

- New vs. Renewals: Distinguishing between new customer acquisition and existing customer renewals is crucial for understanding your revenue sources.

Tailoring Solutions with Qmantic

Budgeting for a SaaS business can be challenging, but you don’t have to navigate this complex terrain alone. At Qmantic, we specialize in assisting SaaS businesses with the budget creation process and seamlessly integrating it into your reporting environment. Every business is unique, and our solutions can be tailored to meet your specific needs. Whether you have questions or require guidance, our team is here to support you on your journey to financial success.

For startups in the SaaS realm, we’ve tailored specialized data solutions that cater to your unique challenges and aspirations. Visit us on Data Solution For SaaS Startups to explore how we can help you organize, analyze, and make the most of your subscription business data. Whether you deal with volume-based pricing, offer multiple add-ons, or have different subscription models, our goal remains constant: to empower your business with data-driven insights.

In conclusion, effective budgeting is the compass that can help steer your SaaS business to success. By understanding the dynamics of subscription revenue, accounting for timing issues, embracing granularity, and considering special factors, you can create a robust budget that empowers you to make informed decisions and navigate the ever-changing waters of the SaaS industry.

🔎 FAQs

1. What’s considered the ideal churn rate for SaaS businesses?

Well, in an ideal world, the churn rate would be zero! However, in reality, the ideal churn rate can vary depending on the industry and the specific SaaS product. A common benchmark to aim for is a monthly churn rate of less than 1-2% for most SaaS companies. It’s crucial to note that when you have limited historical data, determining the appropriate churn rate to consider can be a challenge.

2. How can I accurately estimate upsells and cross-sells in my budget?

Accurate estimation of upsells and cross-sells requires a deep understanding of your customer base and their needs. Utilize data analytics and customer feedback to identify opportunities for upselling and cross-selling. Incorporate these estimates into your budget, but be prepared to adjust them as you gather more data and insights.

3. What tools can help with daily budgeting for SaaS billings?

There are various financial planning and analysis (FP&A) tools and software available that can assist with daily budgeting for SaaS billings. These tools often offer features for real-time tracking, forecasting, and scenario analysis. Some popular options include Adaptive Insights, Anaplan, and Oracle NetSuite.

4. How can I account for product-based seasonality in my budget?

To account for product-based seasonality, analyze historical data to identify seasonal patterns in customer behavior. Consider creating seasonal forecasts that anticipate fluctuations in demand based on past trends. Additionally, adjust your marketing and sales strategies to align with seasonal peaks and valleys.

5. What are the key benefits of tailoring budget solutions with Qmantic?

Qmantic specializes in assisting SaaS businesses with budget creation and integration into reporting environments. By tailoring solutions with Qmantic, you can benefit from expert guidance and customized approaches that align with your business’s unique needs. This ensures that your budgeting process is efficient, accurate, and optimized for success in the fast-paced world of SaaS.